This is one of those posts that has been on my mind for some time so it is not completely formed but wanted to force it down in writing to crystalize my thinking a bit.

Much of what I do now as an early stage investor revolves around trust and risk in relationships. Trust is how much you believe in someone or something – your expectations of engagement. Risk is the downside exposure (loss potential) created by that engagement. This same framework can be applied to personal relationships although in both professional and personal situations there remains considerable gray area.

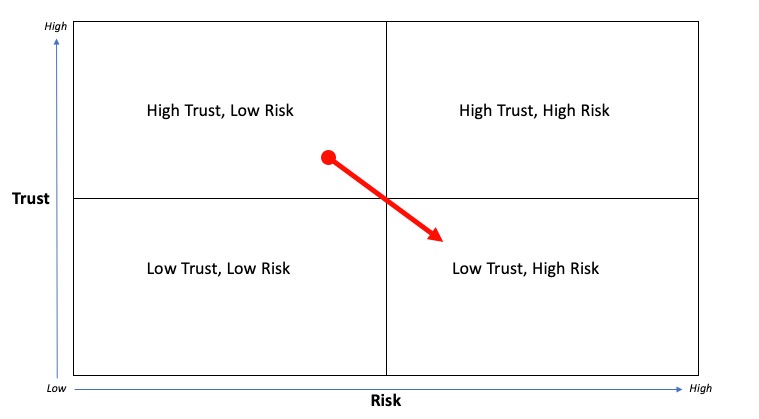

To clarify my thinking on this, I created a pretty standard 4×4 matrix laid out below (yes, I have mad design skills). The four quadrants described on the X and Y axis:

Each quadrant has a distinct relationship profile as follows:

Low Risk to High Risk (X)

Low Trust to High Trust (Y)

High Trust, Low Risk – the relationships you keep closest and depend on. This could be family, friends, business partners, counselors, etc. Your inner circle with the most unconditional relationships.

High Trust, High Risk – this most closely parallels the relationship with early stage founders in my world. Significant risk in the relationship but a level of trust that has led to an investment of time and money. You are aware of the downside risk but have confidence in them to make decisions to navigate that risk. This could also be applied to how LPs in funds view fund managers.

Low Trust, Low Risk – people or entities you interface with but have little to no regard or concern about. Not a priority but also limited to no downside risk from exposure.

Low Trust, High Risk – the ones to watch out for with the combination of lacking trust but can cause significant damage or loss to you.

Relationships can change over time so movement among these quadrants happens with varying levels of consequence and finality:

High Trust to Low Trust – this is most jarring when a trusted relationship violates that trust and becomes untrustworthy. This is hard and often impossible to reverse (Low Trust to High Trust) but can happen.

High Risk to Low Risk – is more of a natural evolution in an early stage company where as the business matures, the risks that could lead to a complete loss are mitigated while less catastrophic risk remains. Moving the opposite direction (Low Risk to High Risk) can happen frequently when assumptions, market conditions, or consequences of a decision come to light. If you invest with a “risk on” mindset, you are aware that this can be fluid with the goal of not being taken completely by surprise.

Of the movements among the quadrants, the most jarring is going from High Trust, Low Risk to Low Trust, High Risk. This can seem like betrayal or being blindsided by a behavior that was unexpected and significantly increases overall risk exposure. Recovering a relationship from this type of dramatic change is rare.

My primary lens on this post is from a professional standpoint and the initial thinking emerged from a sudden High Trust, Low Risk relationship becoming Low Trust, High Risk. I was trying to process what had occurred, how I had missed the potential and why it was bothering me so much.

Without being overly cynical, the same framework can be applied to personal relationships to a degree. Trusted and close relationships are High Trust, Low Risk. Things and people that just don’t matter are Low Trust, Low Risk. The things and people to be wary of are focused on Low Trust, High Risk while you should be eyes wide open on anything or anyone fitting the High Trust, High Risk quadrant.

Thanks for coming to my TED talk….

Ok, got that out of my head and will most likely edit and revise this going forward so stay tuned for that.